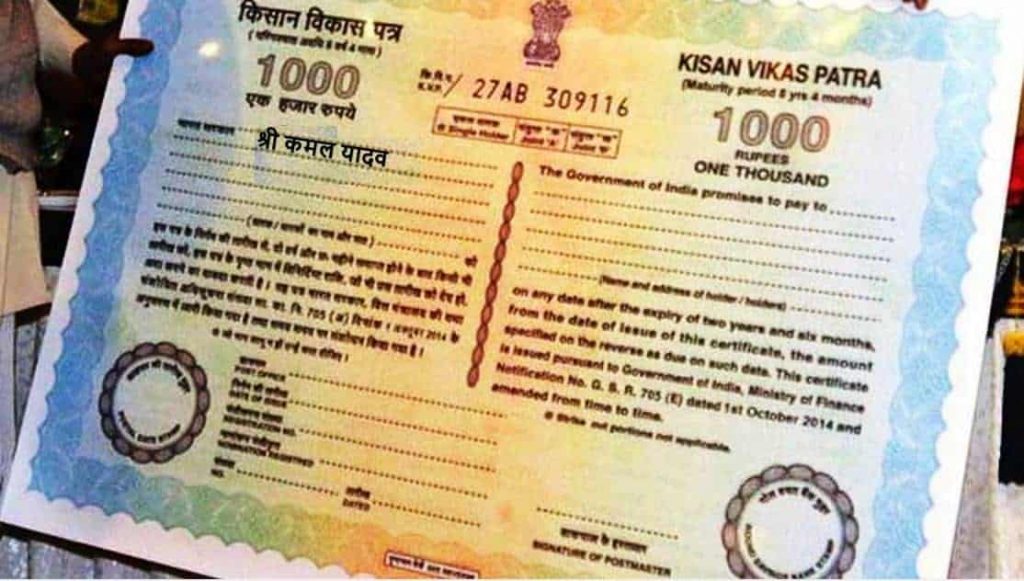

Kisan Vikas Patra ( KVP) Scheme

Kisan Vikas Patra (KVP) scheme is the most prominent scheme among the small savings schemes launched by the Government of India for the citizens . The benefit of high interest rate on the principal amount can be availed through this scheme. From investment point of view this scheme is the best among other schemes. Kisan Vikas Patra Yojana was started by the government in the year 1998 and this scheme was discontinued in the year 2011. This scheme was started again in the year 2014. What is Kisan Vikas Patra (KYP) Scheme and how to apply online? We are giving you information related to this on this page.

Also read: What is MNREGA scheme?

Also read: What is Ayushman Bharat Scheme?

Benefits of Kisan Vikas Patra

The benefits of Kisan Vikas Patra are as follows-

- The current interest rate of Kisan Vikas Patra is 8.70%, which is the highest among other schemes.

- Under Kisan Vikas Patra, your amount doubles after 100 months.

- Kisan Vikas Patra can also be transferred to the name of another person.

- It is available in the form of Rs 1000, 5000, 10000 and 50000, it can be purchased from post offices and nationalized banks.

- The amount invested in this scheme remains completely safe. It gives good returns

- You can withdraw your principal amount from Kisan Vikas Patra.

- It can be transferred from one city to another through post office or bank.

Also read: What is Anganwadi Scheme?

Documents required to buy Kisan Vikas Patra

To buy Kisan Vikas Patra, you will need these documents, which are as follows-

- two passport size photographs

- Identity proof like Ration Card, Voter ID Card, Passport, Driving License etc.

- Proof of residence like electricity bill, telephone bill, bank passbook, Aadhar card etc.

- If you want to invest more than Rs 50000, you will have to provide PAN card, only then you will be able to invest.

Special things to keep in mind while purchasing Kisan Vikas Patra

If you want to invest through Kisan Vikas Patra Scheme, then you should buy Kisan Vikas Patra of small value, with this, whenever you need money, you can withdraw the same amount from the bank or post office. Due to which there will be no impact on your other zodiac signs and you will get good returns.

Also read: Know the government schemes by PM Modi!

Kisan Vikas Patra online application process

- You can also buy Kisan Vikas Patra online, for this you will have to go to the post office or the official website of the bank. There you will get the link of Kisan Vikas Patra online application.

- As soon as you click on the link for Kisan Vikas Patra online application, the complete application form will open in front of you.

- You will have to fill the information of your name, father’s name, address etc. in the prescribed space of the form.

- After this you will have to upload related documents like Voter Card , Aadhar Card, PAN Card etc.

- Now you will get the option to make payment. You can pay it online through net banking , UPI, credit or debit card.

- After payment, you will be issued a bond, of which you can take a print out and keep it safe.

Also read: What is Prime Minister Skill Development Scheme?

Here we told you about Kisan Vikas Patra, if you want to get any other information related to this topic, then you can ask through the comment box, we will answer your questions promptly. We are waiting for your feedback and suggestions.

Also read: Uttar Pradesh Agricultural Equipment Subsidy Scheme

Also read: What is Startup India, Standup India

Also read: What is India Post Payment Bank (IPPB)?